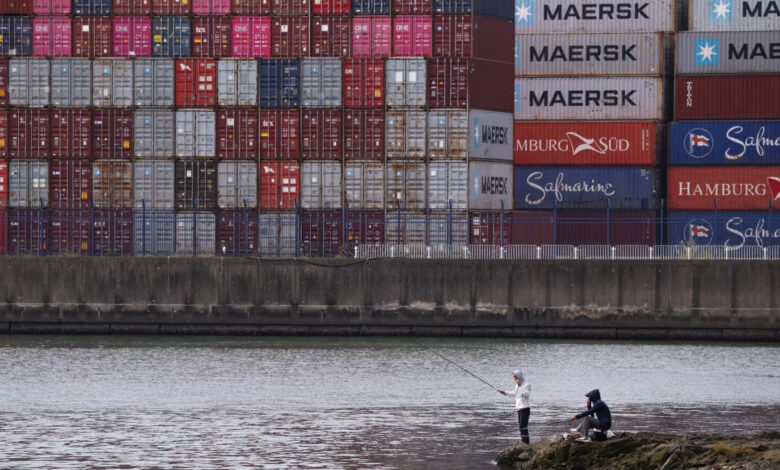

Overall exports from China were 5.9 percent higher than last year in November in dollar terms, customs data released on Monday showed, at $330.3 billion, better than economists’ estimates. That was an improvement from a 1.1 percent contraction in October.

Underscoring a widening gap between overall exports and imports, the customs data showed that China’s trade surplus for the first 11 months surpassed the $1 trillion mark, at nearly $1.08 trillion. That’s a record high for any single year and is more than the $992 billion surplus in all of 2024, based on official data compiled by FactSet.

While exports from China to the US have fallen for most of the year, shipments have surged to other destinations, including Southeast Asia, Africa, Latin America, , Africa and the European Union.

China’s imports increased 1.9 percent in November, at more than $218.6 billion, better than October’s 1 percent growth, even though a persistent downturn in the property sector is still weighing on consumer spending and business investment.

A year-long trade truce between China and the US was reached at a meeting between US President Donald Trump and Chinese leader Xi Jinping in late October in South Korea.

The US has lowered its tariffs on China, and China has promised to halt its export controls related to rare earths.

“It’s likely that November exports have yet to fully reflect the tariff cut, which should feed through in the coming months,” ING Bank chief economist for Greater China Lynn Song wrote in a report.

China’s factory activity contracted for an eighth straight month in November, according to an official survey, and economists said it was still early to determine whether there was a real rebound in external demand following the US-China trade truce.

With exports still going strong, economists generally expect China to more or less meet its economic growth target of around 5 percent for this year.

Chinese leaders had outlined a focus on advanced manufacturing for the next five years following a high-level meeting in October.

An annual economic planning meeting was held on Monday, led by Xi, to map out economic growth plans for 2026, according to state news agency Xinhua, as Chinese leaders reiterated a focus on “pursuing progress while ensuring stability.”

A stable global trade environment is not likely to last long, said Chi Lo, Global Market Strategist, BNP Paribas Asset Management, as China-US relations “remain in a stalemate” despite their temporary trade truce.

Still, some economists believe that China will continue to gain export market share in coming years.

Morgan Stanley predicts by 2030, China’s market share in global exports will reach 16.5 percent, up from about 15 percent currently, fueled by its edge in advanced manufacturing and high-growth sectors such as electric vehicles, robotics and batteries.

“Despite persistent trade tensions, continued protectionism, and G20 economies taking up active industrial policies, we believe China will gain more share in the global goods export market,” Morgan Stanley Chief Asia Economist Chetan Ahya said in a recent note.