Asian shares fell for a third straight day on Wednesday as weak manufacturing reports from China, the United States and Europe fuelled worries about slowing global growth, while the dollar took back some ground lost in the previous session to the safe-haven Japanese yen.

But European markets were seen opening higher and U.S. stock futures rose, suggesting some respite for jittery markets later in the global day after Wall Street shares fell close to 3 percent overnight.

Financial spreadbetters expected Britain's FTSE 100 .FTSE to open up by around 0.5 percent, Germany's DAX .GDAXI to open around 0.5 percent higher and France's CAC 40.FCHI to open up 0.7 percent.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.4 percent, though off session lows, taking its losses to 3 percent so far this week as investors dumped emerging market assets.

Japan's Nikkei .N225 was down 0.5 percent.

But U.S. S&P e-mini equity futures ESc1 were up 0.9 percent, which put a floor under sentiment.

While signs of an emerging market slowdown have been evident for a while in the form of falling commodity prices and weak trade growth, investors had been broadly sanguine on hopes that robust demand from the U.S. and China would keep the global growth engine chugging along.

But this week's weak PMI data has dispelled such notions.

Data showed U.S. factory activity hit a more than two-year low in August while a survey showed China's manufacturing sector shrank at its fastest pace in at least three years last month. In a worrying sign, new order to inventory growth indicated further declines.

"This is the emerging market crisis of 2015," said Dominic Rossi, global chief investment officer of equities at Fidelity Worldwide Management, which manages $290 billion in assets globally.

"While emerging markets are in a far better shape than what they were a few years ago, there may be more pain in store for them," he said.

Investors and money managers are taking no chances. EPFR data for the latest week showed the largest weekly emerging market bond outflows since the "taper tantrum" in 2013 while equity outflows also surged, according to BNP Paribas.

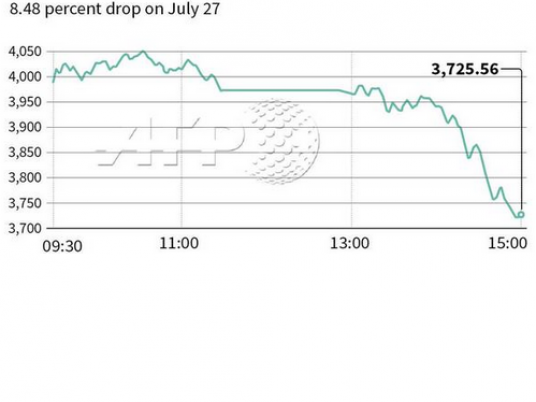

China's major stock indexes extended losses on Wednesday, despite pledges by a number of brokerages to increase their stock investments to support the market.

The CSI300 index .CSI300 fell 1.1 percent in afternoon trade while the Shanghai Composite Index .SSEC lost 0.8 percent, though both were down around 4 percent earlier.

TO HIKE OR NOT TO HIKE?

Facing growing uncertainty over policy in the U.S. and China, all three major U.S. equity indexes are now solidly in negative territory for the year so far.

The downbeat U.S. factory figures made it appear less likely that the U.S. Federal Reserve would opt to hike interest rates at its next meeting later this month, but markets are awaiting Friday's nonfarm payrolls report for August to provide more timing clues.

Economists expect the report to show U.S. employers added 220,000 jobs in August, up from 215,000 in July, a Reuters poll found.

Expectations of an eventual increase to U.S. interest rates had underpinned the battered dollar in recent days, even as investors bought the perceived safe-haven yen and unwound speculative positions funded in euro.

The dollar firmed 0.5 percent to 120.01 yen JPY=, after skidding more than 1 percent overnight and moving away from last week's high of 121.76 yen, while the euro slipped about 0.3 percent to $1.1284 EUR=.

"Currencies will continue to closely watch equities, with the yen and euro boosted by unwinding of carry trades in such times of risk aversion," said Shinichiro Kadota, chief Japan FX strategist at Barclays in Tokyo.

Crude oil futures continued to drop after plummeting 8 percent overnight after the weak Chinese manufacturing data raised fears of slowing demand.

U.S. crude CLc1 was down 2.4 percent at $44.32 a barrel, while Brent LCOc1 fell 2.1 percent to $48.51.

Spot gold XAU= edged down about 0.1 percent to $1,138.40 an ounce, pressured by the stronger dollar, after rising 1 percent in the previous session.

(Additional reporting by Lisa Twaronite and Shinichi Saoshiro in TOKYO; Editing by Kim Coghill)