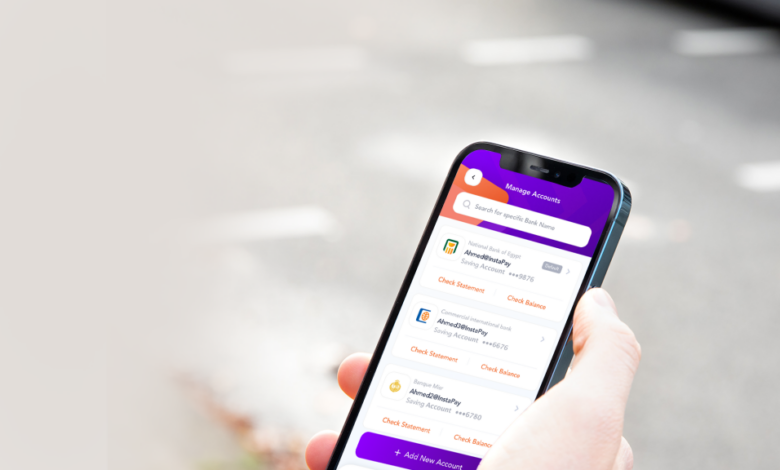

The Board of Directors of the Central Bank of Egypt issued several decisions that include extending the exemption of customers from all expenses and commissions related to bank transfer services for individuals, done through Internet and mobile banking in pounds, and extending the exemption from all expenses and commissions related to transfer services for customers of the national system for instant payments and the InstaPay application.

These decisions come under Egypt’s Vision 2030 to support digital transformation, and are effective from January 1, for a period of three months, renewable.

The decisions also come in continuation of the efforts of the CBE to encourage citizens to use digital financial services, and benefit from the advantages they provide to complete financial services quickly, from anywhere and at any time.

This contributes to achieving the state’s vision to transform into a society less dependent on paper money and enhance financial inclusion.

The National Instant Payments System, launched in April 2022, saw a significant increase in the volume of transactions carried out through it – reaching nearly 1.5 billion transactions worth up to LE2.9 trillion during 2024, while the number of service users reached nearly LE 12.5 million customers.

A banking source said that the CBE is studying the application of fees on transfers and transactions made through the InstaPay application during 2025.

The source explained that the value of these fees has not yet been determined for transactions made through the application, but will most likely be simple and symbolic fees.

Banking expert Tarek Metwally explained that the Central Bank’s decision to postpone the collection of fees on transactions came after conducting data analysis and extracting information that showed an increase in the number and values of transactions conducted through the national system for instant payments.

This reflects the need to increase the daily and monthly limits for transactions conducted through the InstaPay application, he said, with the aim of attracting and accommodating various segments of society to enhance digital transformation.

Edited translation from Al-Masry Al-Youm