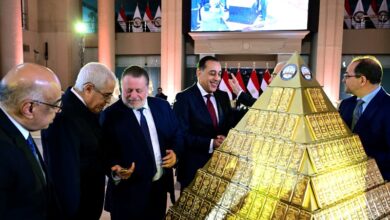

The Central Bank of Egypt announced that the value of gold listed in foreign exchange reserves by the end of July amounted to US$ 7.974 billion, compared to $7.738 billion at the end of June – an increase of $236 million.

The CBE added that the value of foreign currencies included in the cash reserve declined to $26.530 billion by the end of July, compared to $27.044 billion at the end of June, a decline of $514 million.

It pointed out that the net foreign exchange reserves rose to $34.879 billion by the end of July, compared to $ 34.807 billion in June.

On June 6, the CBE stated that the country’s net international reserves reached $34.660 billion at the end of May, compared to $34.551 billion in April.

The CBE earlier in August surprised the banking market with an unexpected decision to raise interest rates by 100 basis points, equivalent to one percent on deposit and lending operations and the price of the main operation.

The lending rate was increased to 20.25 percent, the deposit rate to 19.25 percent and the main operation rate rose to 19.75 percent.

The credit and discount rates were also raised by 100 basis points to 19.75 percent.

The committee believes that inflation rates are expected to peak in the second half of 2023, before returning to the previously announced target inflation rates supported by restrictive monetary policies so far, it added.