As the real estate market continues to improve in Egypt, new trends are shaping the market in 2018.

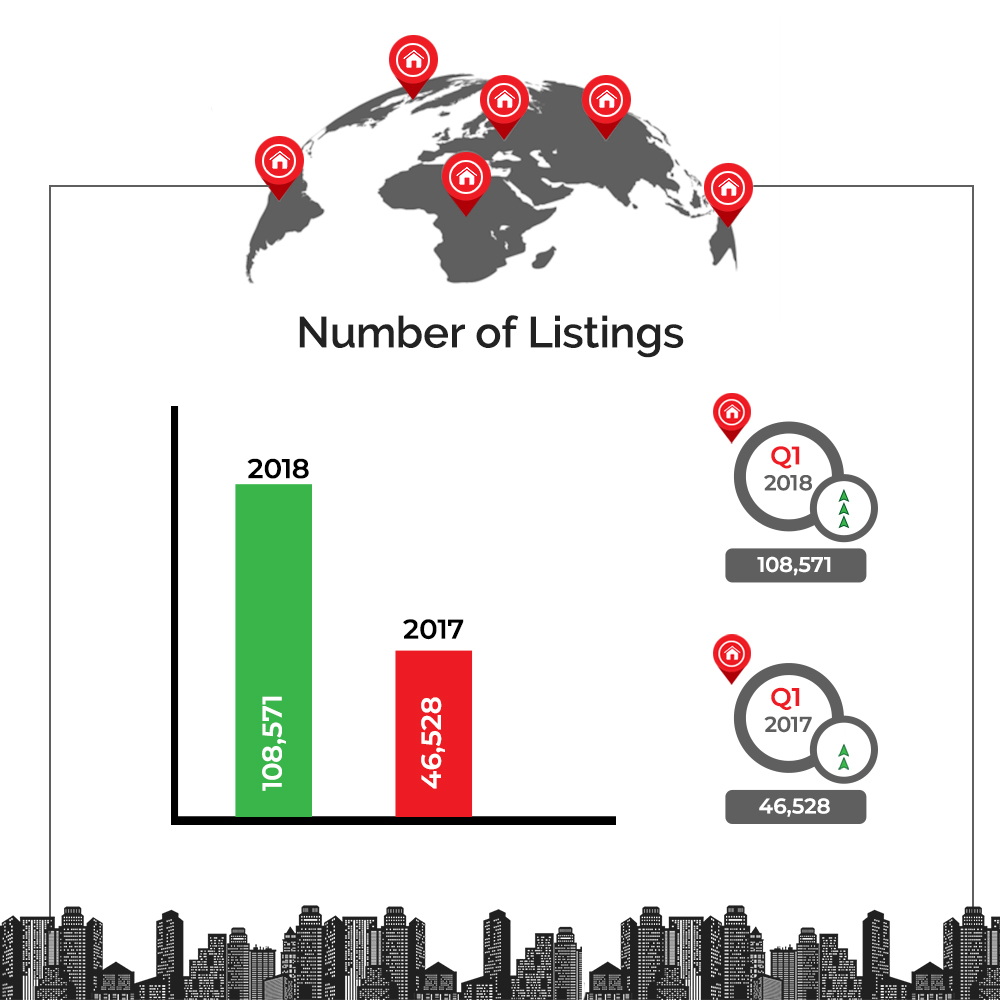

The report released by Propertyfinder Egypt shows a growth rate of 133% to the number of listings added to its portal. This remarkable growth is a result of the huge increase in the number of new projects launched in late 2017 and early 2018, particularly in the emerging cities; “New Administrative Capital” and “Future City”.

However, according to the emerging trends in Real Estate market published by Propertyfinder, new measures should be taken to cope with the new market that is influenced by a gradual reverse in the interest shown in most property types.

Find out the top 5 trends in Real estate market in 2018 introduced by “propertyfinder.eg” and stay ahead of the game.

1. Investment-driven Home Purchase

While Egypt has witnessed a great deal of instability and uncertainty in most fields since the Egyptian pound devaluation, property investment seems to be one of the few areas that have flourished. The ongoing rise in inflation rate has left most people with the choice of either turning their savings into foreign currency or property assets.

With a large number of developments introduced to the marketplace, the real estate managed to attract investment over other uncertain options; leading to a great flow of money into the real estate sector for investment rather than housing purposes.

This is quite apparent in the interest shown by most citizens in new compounds that are still under development all across Cairo and Giza like: Sun Capital and Trillium in 6th of October city, Gevenova and Aeon in Sheikh Zayed City, HAPTOWN in future city, along with City Gate and Azzar in New Cairo. Noting that the delivery date of those compounds is after 4 or 5 years.

2. The Gap Between Supply and Demand

Despite the great supply that has been introduced to the market by various developing companies, the demand for housing remains uncovered.

According to statistics, Egypt has a population of over 90 million people that require from 175,000 to 200,000 units every year to meet the shortage in housing units that is equal to 3.5 million.

Even though reports have confirmed over 5 million vacant units available across the country, the prices of those units are extremely high that they exceed the purchasing power of low and middle-income classes. While the GDP per Capita in Egypt is equal to 2724.40 USD, the average price per square meter in new cities is equal to 18,000 LE.

However, the government is leading great efforts to cover this gap between supply and demand by building new cities with more affordable prices across Egypt like New Capital City, Al Alamein City, New Mansoura City, New Fayoum City, New Aswan City, …etc.

3. A Fundamental Change in the Demand Environment

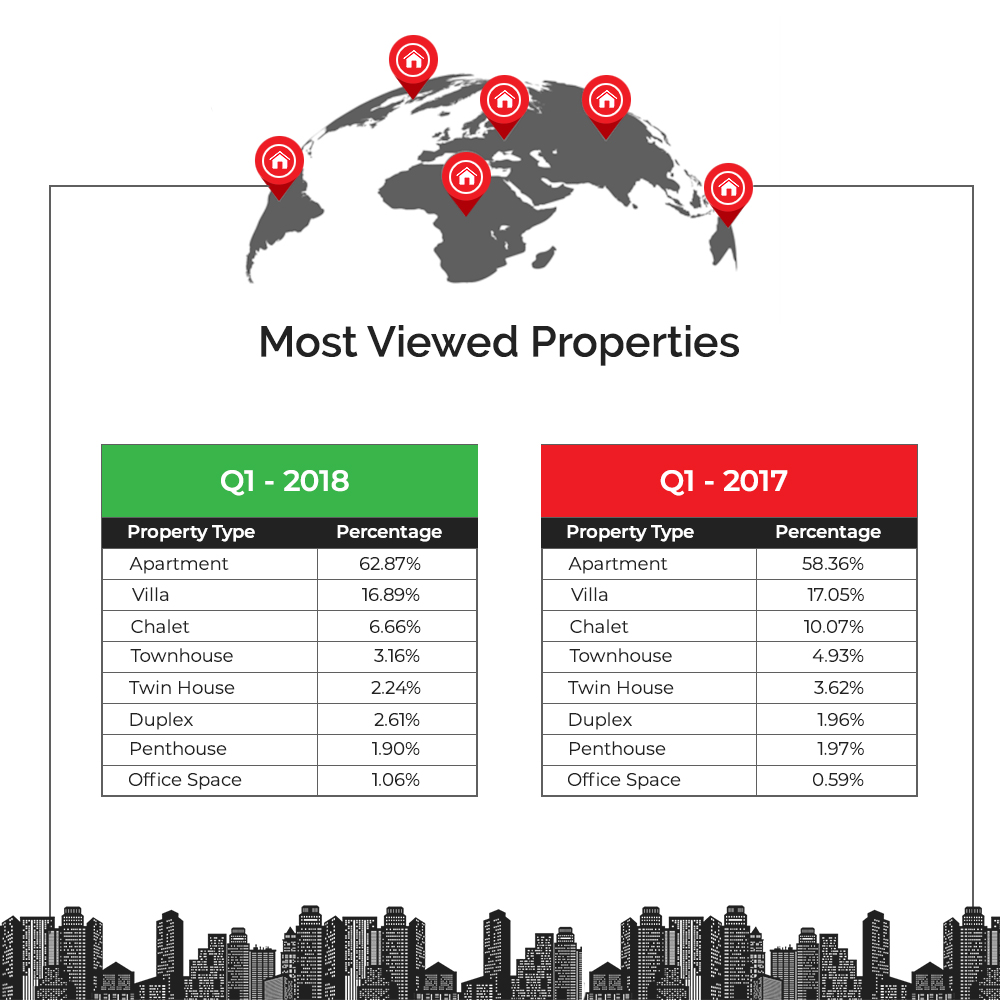

Based on the data reported by propertyfinder regarding the most viewed property types on its portal in 2018, it has been shown that the demand for different property types has shifted greatly since 2017 as follows:

Mohamed Hammad – Propertyfinder’s Managing Director – attributed this growth in the demand for apartments for sale at the expense of other property types like Duplexes and villas to the high prices that have led most people to downgrade their residence.

“While comparing the numbers, it can be easily noted that the real estate market had not been affected by the floating of the Egyptian pound in 2017, while it reflected greatly on the market in 2018 on account of the high prices. This has led those looking for villas to downgrade to townhouses and those looking for townhouses to downgrade to apartments and so on,” Hammad noted.

It can also be concluded that the demand for chalets decreased as a result of the low economic level, driving people to stick to their basic needs and neglect the need to have holiday homes. Also, the high demand in new cities has led most people to invest in residential areas rather than holiday destinations for more profitable investments.

On the bright side, huge foreign investments, especially from the gulf area, entered the country with businesses in all fields as a result of the devaluation of the Egyptian currency; resulting in a higher demand for office spaces along with twin houses as they are the most common and favorable property type in the Gulf.

4. Demand for Properties Across Seas

The most appealing places for investment are not only in Cairo governorate but also in Giza and the demand stretches across seas in Alexandria, the Red Sea, and Suez.

However, the report presented by propertyfinder shows that the most searched properties for sale in the coastal areas in 2018 are located in Al Ain Al Sokhna. This might be attributed to the large projects developed in the city like IL MONTE GALALA as well as its close location to the country’s mega project “New Capital City”.

Al Ain Al Sokhna has always been Cairo’s nearest escape, however, its prime location near New Capital City – with less prices – has caused many people to consider not only having a holiday home in Ain Sokhna but actually living there with a short commute time compared to most of the cities within Cairo.

5. Best Buy Cities in 2018

Based on propertyfinder’s report regarding the highest demand on residential areas on propertyfinder.eg in 2018, it has been shown that the top areas to invest in are:

6th of October City.

The 5th settlement in New Cairo City.

North Investors Area and South Investors Area in New Cairo City.

El Katameya in New Cairo City.

Sheikh Zayed City.

It is quite notable that the search for the least prices is the biggest trend of 2018. With that being said, Hammad stated: “ 6th of October City’s ranking highest on the list of the most searched areas in 2018 is logically reasoned upon the high prices in New Cairo City and the 5th settlement. This caused most people to escape to more reasonable prices in 6th of

October city where the price per meter in some areas is 4,000 LE or even less than 3,000 LE.”

On the other hand, the 5th settlement and Street 90 in New Cairo are the top searched areas when it comes to commercial business as they attract investments from inside and outside Egypt. These areas hold some of the biggest commercial malls in Egypt and they are also the most vibrant areas in the city.

However, in the coastal areas, Alexandria ranks number 1 on the list of the most searched areas for commercial business. This is due to its position as the second largest capital to Egypt after Cairo as well as its prime location on the Mediterranean coast of Egypt; resulting in it being the main port city in the country. All of those privileges attract the pioneers of business to expand their investments in Alexandria. In addition, the extension to Borg El Arab city that has been made two years ago increased its value as a superb holiday destination and residential area.

Regarding the most searched areas for residential rent, the list of the top areas according to Propertyfinder’s report go as follows:

Maadi, particularly in Sarayat Al Maadi

Zamalek

New Cairo

Sheikh Zayed

The high demand on each area is separately justified by its geographical nature and services. As Hammad noted: “It is mostly known that expats are the main segment that is interested in rentals in Egypt; which explains the high demand in those areas, especially Zamalek as it holds most of the foreign embassies. Also, Maadi’s urban distribution is different from any other residential city in Egypt as it is divided into squares that connect all the city together which attracts most foreigners in Egypt.”

In addition, New Cairo holds a huge number of schools and universities like: British and Canadian schools and the International Choueifat School along with the American University in Cairo and the German University in Cairo.

This has always attracted students from all over the world to live in New Cairo near their studies. And while Sheikh Zayed offers the same privileges as New Cairo when it comes to the number of educational institutions located in it, Arab expatriates seem to prefer it as it is similar in its nature and environment to their homelands.

Summing up, it is unsurprising that the real estate sector in Egypt is witnessing some alteration regarding demand due to the devaluation of the Egyptian pound. This change divides the market now into two main dynamics; increased supply in one end of the spectrum with prices that qualify it only to high-income levels. While on the other hand, high demand remains unfulfilled on lower income scales.

On one end, there are warning signs of a bubble forming while on the other end, there is lack of supply. This means that a shift in supply trends is crucial for the health of the real estate sector in Egypt.