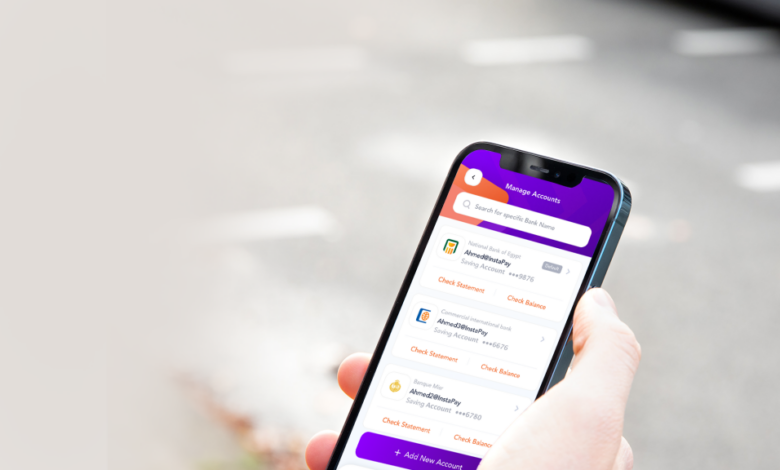

The InstaPay application on Sunday has launched a new update for several of its services, allowing for instant money transfers between users through QR codes and a payment link.

The new feature enables the beneficiary to share the QR Code to the other party wishing to transfer the money, as an alternative method to manually exchanging transfer data such as payment address.

As the QR Code is read through the camera, this will reduce the risk of data entry mistakes.

How to transfer money instantaneously on InstaPay

The QR Code requires these steps:

- The sender and the beneficiary must be in the same place, as InstaPay has created a mechanism for sharing the Payment Link with the party wishing to transfer as an alternative to sharing the payment address or entering the transfer data manually.

- When you click on the payment link, InstaPay application automatically completes the beneficiary’s data through the link and carries out the transfer process directly without the need to enter the data manually.

Withdrawal limit

The Central Bank of Egypt (CBE) set limits for transfer as the following:

- LE 70,000 per transaction.

- LE 120,000 daily debit per bank.

- LE 400,000 monthly debit per bank.

The launch of InstaPay

The CBE in 2022 announced the official launch of the national system for the instant payments network and InstaPay for banking sector customers, allowing financial transactions to be conducted electronically and instantly.

It utilizes a real-time payments network to facilitate money transfers and electronic payments.

The step was implemented as part of the digital transformation strategy of the National Payments Council, headed by President Abdel Fattah al-Sisi.

The launch of InstaPay is an important step towards achieving the Central Bank’s comprehensive vision of national payment systems.

Edited translation from Al-Masry Al-Youm