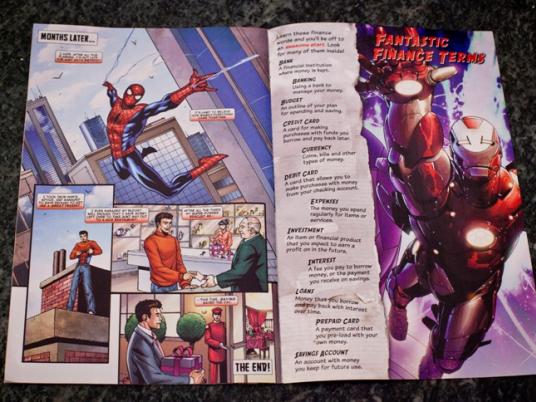

The comic book begins much as would be expected: Marvel comics’ the Avengers and Spiderman assemble to battle a villain intent on destroying humankind. But there’s a twist.

Set in a modern bank, the superheroes battle a villain intent on robbing the world’s financial institutions, all while explaining to the financially illiterate Spiderman, who is trying to save up for a nice birthday present for his aunt, how budgeting and saving can help him accomplish his personal finance goals.

Sponsored by the global payment technology company Visa, and available in Arabic and English, among other languages, the comic book is part of the company’s push for international financial literacy and inclusion.

Visa helped produce the comic book in the hope that it would serve up financial and saving lessons in a palatable form for young minds.

Over the past decade, the company has been promoting its worldwide financial literacy and inclusion initiative on the basis that a more financially savvy and banked world is also one with less poverty.

“We share this goal of advancing financial literacy, which is particularly acute in emerging economies, because managing money is a prerequisite to overcoming poverty,” Kamran Siddiqi, Visa’s Middle East and North Africa general manager, said at the Visa financial literacy conference in Dubai last month.

Visa would also benefit from drawing more of the world’s unbanked into the financial fold. If the world’s estimated 2.5 billion unbanked people, according to a Visa study, were brought into the formal banking sector, this would mean more customers for the world’s largest payments processing company.

Egypt is one of the emerging economies Siddiqi mentioned in which the company is looking to make serious inroads. Some studies have put the percentage of Egyptians holding a bank account at roughly 10 percent, though that figure is likely outdated.

Experts say this percentage could grow rapidly in the coming decade, as the government looks to formalize more of the economy, particularly small- and medium-sized enterprises.

As more businesses take advantage of banking services, their employees will likely receive their salaries through bank accounts, and as more receive electronic payments, it will be easier for many of them to avail themselves of bank loans and savings accounts.

The important thing, experts say, is for citizens to understand how to manage a budget before moving to more complicated financial services, such as loans or credit, or else new bank customers can get trapped in a cycle of debt.

Money smarts

Studies have shown that Egyptians, at least from certain socio-economic levels, are already fairly used to living on a strict budget.

A 2012 study on global financial literacy by Kiplinger’s Personal Finance Magazine found that Egypt ranked 14th out of 28 nations surveyed in the financial literacy of its population.

The study, released by Visa, placed Egypt in eighth place for the number of households that abide by a budget. The country came in 10th for how many times parents discussed money management with their children.

Parents from poorer households were more likely to talk with their children about finance, saving and debt, according to the study.

It’s unclear how banks will treat individual lenders and customers in the future, and whether Egyptians’ current budget skills will be sufficient for citizens to navigate the world of modern finance.

An October report in the independent financial newspaper Al-Mal found that banks have slightly increased their lending to individuals since January last year, with experts expecting a further increase.

Khaled Hassan, assistant manager of retail banking at the Arab National Bank, told Al-Mal that he expects the number of individual loans to increase in the coming period, as Egypt recovers from its liquidity problem and as more banks offer Sharia-compliant loans and services.

A traditional approach

In the past decades, private banks have had little incentive to issue loans and provide credit services to individuals. There was little reason for them to woo the average Egyptian citizen.

It was much more profitable for big banks to go after the high rollers, whose fortunes could fill their coffers much more quickly.

To open an account, banks require a minimum balance and proof of monthly income. But Egyptians have nonetheless found clever solutions for their finance needs. Many rely on loans from family and friends, or other traditional finance options.

One of the most popular financial tools is the “gamaiyya,” an informal saving group in which participants, usually friends or kin, deposit on a monthly basis, collecting it after the gamaiyya’s term. The system is essentially community-enforced saving, without the bank fees or hassle.

For Egyptians to become financially literate, experts say, both traditional and modern financial tools should be used. Nima Abu-Wardeh is the founder of Cashy, a personal finance social media platform, aimed at the Arab world, where users trade financial tips and stories.

Egypt’s existing culture of traditional finance tools means consumers are prepared for more sophisticated ones, Abu-Wardeh said. She’s hoping to expand Cashy and develop an Egypt-specific portal.

“There, people could talk about how to combine using gamaiyyas with modern banking tools,” she said. “That’s the important thing, for there to be a conversation among people about what works for them.”

The danger of wealth

There are cautionary tales for Egyptians, if they look to their Gulf neighbors. Blessed with huge oil and gas reserves, the United Arab Emirates has seen many of its citizens go from not holding a bank account to trading stocks and bonds in just a couple decades.

Now, as the country’s skyrocketing growth has slowed, some of its citizens’ irresponsible financial practices have been laid bare.

“I notice our kids, they never look at the price tag of anything they buy,” said Fatima al-Maury, a representative from the Emirati public school system, also at the conference in Dubai. “Our kids are not used to the value of money, as we are.”

Now, she said, Emiratis must strive to return to their more humble roots to teach the new generation financial responsibility.

“We always spend and spend and spend,” she said. “We must be responsible for changing that, by setting a good example.”

There is evidence that a financially literate and banked population means a wealthier economy overall.

“The more people are banked, the more liquidity there is in the economy,” said Malak Reda, a senior economist at the Egyptian Center for Economic Studies. “The more responsible individuals are with their money, the stronger the banking system.”

It’s a skill that’s generational and usually passed on through families, experts say, meaning parents and teachers bear the greatest responsibility for teaching children thriftiness.

“I’ll never forget the wooden box my parents gave me, in which they encouraged me to save coins,” said Siddiqi.

Egyptian parents must continue to pass down these skills, for their children to learn how to handle the siren call of never-ending credit and debt.

If they are careful, they could end up like Spiderman at the end of the comic, who not only defeats the villain looking to steal the banks’ cash, but also saves enough money to both buy a nice birthday present for his aunt and take her out to a fancy dinner.

As he says, “This time, SAVING saved the day.”

*Correction: This article previously stated that Visa is a credit services company. It has been corrected to show that Visa is a payment technology company, through which banks then are able to offer credit services.