Business activity in Egypt's private sector excluding oil grew slightly in June, ending five months of contraction, though inflation and currency depreciation remain a concern, a survey showed on Sunday.

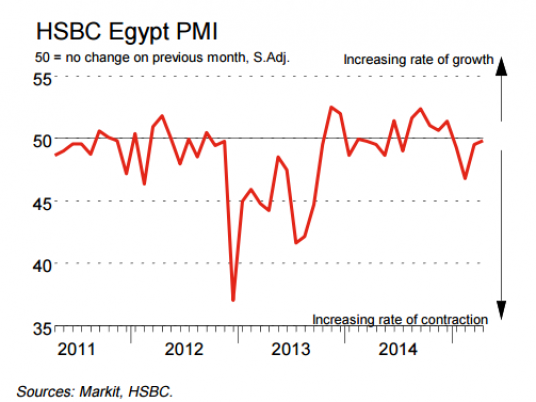

The Emirates NBD Egypt Purchasing Managers' Index rose to 50.2 in June from 49.9 the previous month. A reading above 50 indicates expansion and below 50, contraction.

"June's PMI reading fits well with our view that the Egyptian economy should gradually pick up momentum heading into the second half of 2015," Jean-Paul Pigat, economist at Emirates NBD, said.

"However, the survey also shows business activity and job creation remaining relatively tepid."

Output, new orders and new export business all increased but only slightly. Input costs continued to rise sharply, which respondents attributed to the weakness of the Egyptian pound.

The central bank depreciated the pound by 1.3 percent on Thursday, sending it to its weakest level since December 2012.

The currency has lost around 30 percent of its value since a 2011 uprising which was followed by years of political and economic turmoil.

President Abdel Fattah al-Sisi has pledged to revive the economy by implementing long-awaited reforms, launching state-led mega projects, and enticing foreign investors and tourists scared away by the upheaval.

Foreign firms are signing deals. BP finalised a $12 billion energy deal with Egypt at an investment conference in March and Germany's Siemens sealed a $9 billion energy deal during Sisi's recent visit to Berlin.

"Looking ahead, assuming some of the high-profile projects announced at the March investor conference break ground over the coming months, we would expect to see a further acceleration in new orders and output in the second half (of the year)," said Pigat.

Yet there are signs of growing frustration with Sisi among ordinary Egyptians, whose standard of living is constrained by rising inflation and continued unemployment.

The PMI survey showed hiring dropped for the sixth time in seven months.