The balance of foreign exchange reserves at the Central Bank of Egypt increased at the end of April by about US$41 million.

The reserves recorded $37.1 billion at the end of April, compared to $37.08 billion in the previous March, to regain its balance after losing $3.9 billion due to the Russian-Ukrainian crisis.

During March, the Central Bank of Egypt used part of the foreign exchange reserves to cover the Egyptian market’s foreign exchange needs.

The CBE also used a part of the foreign exchange reserves to cover the exit of foreign investments and international portfolios, as well as to ensure the import of strategic goods, in addition to the payment of the international obligations of the country’s external indebtedness.

The reserve can cover more than five months of merchandise imports, surpassing international indicators of reserves adequacy.

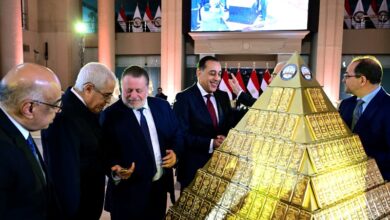

The main function of the CBE’s foreign currency reserve – made up of gold and various international currencies – is to provide commodities, repay installments and external debt, and cope with an economic crises during exceptional circumstances.

The reserves also help when the main sources of foreign currency for Egypt (tourism, exports and investments) become impacted in times of unrest.

Other sources of hard currency, such as remittances from Egyptians abroad (which have reached record levels) and Suez Canal revenues, contribute to the reserves.