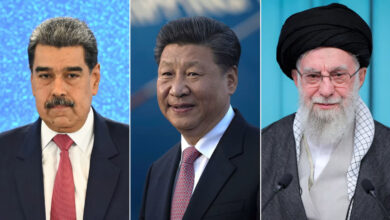

Venezuela’s unraveling socialist government is increasingly turning to ally Russia for the cash and credit it needs to survive, and offering prized state-owned oil assets in return, sources familiar with the negotiations told Reuters.

As Caracas struggles to contain an economic meltdown and violent street protests, Moscow is using its position as Venezuela’s lender of last resort to gain more control over the OPEC nation’s crude reserves, the largest in the world.

Venezuela’s state-owned oil firm, Petroleos de Venezuela (PDVSA), has been secretly negotiating since at least early this year with Russia’s biggest state-owned oil company, Rosneft (ROSN.MM) – offering ownership interests in up to nine of Venezuela’s most productive petroleum projects, according to a top Venezuelan government official and two industry sources familiar with the talks.

Moscow has substantial leverage in the negotiations: Cash from Russia and Rosneft has been crucial in helping the financially strapped government of Venezuelan President Nicolas Maduro avoid a sovereign debt default or a political coup.

Rosneft delivered Venezuela’s state-owned firm more than $1 billion in April alone in exchange for a promise of oil shipments later. On at least two occasions, the Venezuelan government has used Russian cash to avoid imminent defaults on payments to bondholders, a high-level PDVSA official told Reuters.

Rosneft has also positioned itself as a middleman in sales of Venezuelan oil to customers worldwide. Much of it ends up at refineries in the United States, despite US sanctions against Russia, because it is sold through intermediaries such as oil trading firms, according to internal PDVSA trade reports seen by Reuters and a source at the firm.

PDVSA and the government of Venezuela did not respond to requests for comment.

The Russian government declined to comment and referred questions to the foreign ministry and the ministries of finance and defense, which did not respond to questions from Reuters. Rosneft declined to comment.

Russia’s growing control over Venezuelan crude gives it a stronger foothold in energy markets across the Americas. Rosneft now resells about 225,000 barrels per day (bpd) of Venezuelan oil – about 13 percent of the nation’s total exports, according to the PDVSA trade reports. That’s about enough to satisfy the daily demand of a country the size of Peru.

Venezuela gives Rosneft most of that oil as payment for billions of dollars in cash loans that Maduro’s government has already spent. His administration needs Russia’s money to finance everything from bond payments to imports of food and medicine amid severe national shortages.

For a graphic detailing the decline of Venezuela’s oil industry, see: tmsnrt.rs/2fwsuCV

Venezuela’s opposition lawmakers say Russia is behaving more like a predator than an ally.

“Rosneft is definitely taking advantage of the situation,” said Elias Matta, vice president of the energy commission at Venezuela’s elected National Assembly. “They know this is a weak government; that it’s desperate for cash – and they’re sharks.”

Matta echoed many others in the opposition-majority congress who have blasted corporate deals they say are underpinning Maduro’s efforts to establish a dictatorship.

The Venezuelan government has said previously that Russia’s investment in its oil industry shows confidence in PDVSA’s financial stability and the nation’s business opportunities.

Maduro’s administration has grown increasingly dependent on Moscow in the past two years as China has curtailed credit to Venezuela because of payment delays and the corruption and crime faced by Chinese firms operating there, according to Venezuelan debt analysts and two oil industry sources.

Many multinational firms worldwide, meanwhile, have all but written off their Venezuelan operations amid the nation’s tanking economy and chronic shortages of raw materials.

Rosneft is making the opposite play – using Venezuela’s hard times as a buying opportunity for oil assets with potentially high long-term value.

“The Russians are catching Venezuela at rock bottom,” said one Western diplomat who has worked on issues involving Venezuela’s oil industry in recent years.

As other companies shutter operations here, Rosneft has expanded to an additional floor of its office tower and added staff. The Russian firm has poached PDVSA professionals and brought in more Russian executives, two sources close to Rosneft told Reuters.

The corporate expansion provides a striking contrast to the scene on the streets below these days, in the once-thriving business district of Caracas.

As Rosneft staffers work in swanky offices alongside posters of Russian President Vladimir Putin and a bust of Hugo Chavez, the late Venezuelan leader and socialist icon, crowds of young men outside often throw rocks and Molotov cocktails in escalating protests of Chavez’ successor.

Rosneft currently owns substantial portions of five major Venezuelan oil projects. The additional projects PDVSA is now offering the Russian firm include five in the Orinoco, Venezuela’s largest oil producing region, along with three in Maracaibo Lake, its second-largest and oldest producing area, and a shallow-water oil project in the Paria Gulf, the two industry sources told Reuters.

In a separate proposal first reported by Reuters last month, Rosneft would swap its collateral on 49.9 percent of Citgo [PDVSAC.UL], the Venezuelan owned, US-based refiner, for stakes in three additional PDVSA oil fields, two natural gas fields and a lucrative fuel supply contract, according to two sources with knowledge of the negotiations.

Under the proposal, Rosneft would also take increased management control over all the joint oil projects between the two firms.

Rosneft secured the collateral late last year on a loan of $1.5 billion to PDVSA.

The negotiations over a collateral swap are driven in part by a recent threat from US President Donald Trump to sanction Venezuela’s oil sector as punishment for Maduro’s efforts to undermine the nation’s elected congress.

Rosneft has already been sanctioned by the United States over Russia’s annexation of Crimea from Ukraine in 2014. Such actions require US firms to end business relations with sanctioned entities.

Maduro’s need for Russian cash played a key role in a move by his political allies earlier this year that destabilized Venezuela’s already teetering democracy, the top Venezuelan government official told Reuters.

In March, the nation’s Supreme Court, whose members are loyal to Maduro, took over the powers of the opposition-controlled National Assembly. A majority of elected Assembly members opposed any new oil deals with Russia and insisted on retaining power to veto them.

Days later, after fierce national protests against the action, the court returned most powers to the national legislature at Maduro’s public urging. But the court allowed the president to keep the legal authority to cut fresh oil deals with Russia without legislative approval.

The episode was pivotal in escalating daily street protests and clashes with authorities that have since caused more than 120 deaths.

Maduro needed sole authority to cut new oil deals to clear the way for Rosneft’s expansion, the top Venezuelan government official told Reuters.

“Pressure from Russia has played an important role in Nicolas Maduro’s decisions,” the official said, speaking on condition of anonymity because he was not authorized to make public comments.

Rosneft said this month that it has lent a total of $6 billion to PDVSA. In total, Russia and Rosneft have delivered Venezuela at least $17 billion in loans and credit lines since 2006, according to Reuters calculations based on loans and credit lines announced by the government.

Venezuela does not publish the full details of the debts it owes Russia.

Maduro has sought to limit the power of congress since the opposition won a majority in 2015.

In late July, he created a legislative superbody called the Constituent Assembly in an election that was widely criticized as a sham. Allies of the Socialist Party won all 545 seats in the new assembly, which has the power to rewrite the nation’s constitution, dissolve state institutions, such as the opposition-run Congress, and fire dissident state officials.

Venezuela’s oil-based economy has collapsed since international prices crashed to a low of $24 per barrel in early 2016 from more than $100 in 2014. Prices now hover at about $50, which hasn’t proven high enough to pull Venezuela out of its tailspin.

Nearly all of the nation’s export revenue comes from oil, so income has fallen sharply and a shortage of petrodollars has left Maduro’s government unable to finance the generous subsidies of food, medicines, fuels, power and other public services instituted by his predecessor, Chavez.

The erosion of subsidies has contributed to rapid inflation, which is forecasted to top 700 percent this year by the International Monetary Fund. Venezuela’s currency, the bolivar, has become nearly worthless.

Government spending cuts have also slashed budgets for maintaining the nation’s oilfields, refineries, ports and tankers, causing Venezuela’s oil output in the first half of 2017 to fall to nearly its lowest level in 27 years.

PDVSA is repaying a growing portion of its mounting debts to Russia with oil, according to internal PDVSA trade data reviewed by Reuters. The oil payments are choking off the cash flow from its petroleum business – thereby creating the need for more loans.

The nation’s downward spiral has put Rosneft in a position to acquire Venezuelan oil assets on the cheap.

Of the package of stakes PDVSA has offered to Rosneft, the most valuable is a 10 percent stake in Petropiar, a multi-billion dollar project to produce and upgrade extra heavy crude in the Orinoco Belt.

The value of the stake is likely between $600 million and $800 million, based on the valuations of similar deals.

The rising volumes of Venezuelan crude that Rosneft receives have made the Russian firm a middleman in sales to refiners that once bought directly from PDVSA. The oil payments have also helped Rosneft grow a major oil trading business to complement its massive production apparatus.

In the process, the Russian firm has appropriated some of PDVSA’s hard-won international supply deals and valuable trading relationships with refiners as far afield as China, the PDVSA documents show.

At today’s prices, the Venezuelan oil exports that flow to Rosneft would be worth about $3.6 billion annually. And the flow of PDVSA crude to Rosneft is expected to keep increasing, according to the internal PDVSA documents.

Most of it is sold into the United States, according to the documents.

Rosneft also will soon start selling Venezuelan crude to India’s refiner Essar, taking PDVSA’s second largest customer in the Asian country.

“Russia is taking everything they have,” said an oil trader who regularly deals with PDVSA.

The Russian strategy has its risks. Many of the world’s top energy firms took a hit when Chavez nationalized their assets, and an opposition-led government could later reverse or revise any deals Maduro cuts without their blessing.

Venezuela’s bond yields are among the highest in the world because of the nation’s high default risk. The bonds pay nearly 30 percentage points more than benchmark US treasuries.

PDVSA’s many connections to the United States oil industry also raise the specter that the deals now under negotiation could run afoul of US economic sanctions already in place against Russia and threatened against Venezuela.

The Petropiar project, for instance, is 30 percent owned by US oil major Chevron Corp (CVX.N).

Should Rosneft take a stake in the project, it could be complicated for Chevron to ensure it is not violating US sanctions. In the meantime, Chevron has sent guidelines to executives to ensure they comply with sanctions, an employee at Chevron told Reuters.

The guidelines advise staff, for instance, to avoid one-on-one meetings with sanctioned entities or officials, the employee said. In a statement, Chevron said it abides by “a stringent code of business ethics” and complies with applicable laws.

For now, Russia’s status as chief lender to PDVSA has put Rosneft in a position to supercharge its holdings and profits in the region.

If Venezuela’s government defaults on its debt payments, an increasingly likely scenario, Rosneft likely will be one of the entities at the front of the queue as a creditor because of its large collateral stake in US-based Citgo, according to a confidential independent analysis of its debt commissioned by an investment fund and seen by Reuters.

Representatives of Citgo, PDVSA’S largest foreign asset, did not respond to requests for comment.

Rosneft’s involvement in Venezuela can be traced back to a $4 billion arms-for-oil deal in 2006 that cemented the bond between the governments of Chavez and Putin. Chavez, a former military officer, signed the deal himself in Moscow.

Shunned by the United States, which since 2006 has refused to supply spare parts for Venezuela’s fleet of US-built F-16 fighter jets, Chavez bought Russian Sukhoi fighter jets, helicopters, tanks and guns from Putin.

Top executives from Rosneft and PDVSA were later involved in negotiations related to the military purchases because Rosneft was the Russian entity receiving the Venezuelan oil cargoes used to pay for a portion of the weapons, the top Venezuelan government official told Reuters.

They included Rosneft President Igor Sechin, a powerful long-time advisor and deputy to Putin. Sechin is a trained linguist who began his career as a military interpreter and has a passion for the history of Latin America’s revolutionaries, according to two people who worked with him.

He had a direct line into Chavez until the former president’s death in 2013, the Venezuelan official told Reuters. Sechin has maintained close ties with Maduro and the two meet regularly, the official said.

Speaking to reporters in at a hydroelectric plant in Russia last week, Sechin called Rosneft’s growing investments in Venezuela an obvious and essential play.

“This is a country with the world’s hydrocarbon reserves,” he said, referring to a central component of oil and natural gas. “Any energy company should aim to work in this country … No one could force us from there.”

Russia was swift to defend Maduro’s government from international criticism after the Supreme Court moved to nullify congress, with Moscow issuing a statement saying foreign governments should not meddle in Venezuelan domestic politics.

Sechin was Maduro’s guest of honor at a ceremony last October to unveil a Russian-made granite statue of Chavez erected in the late president’s hometown of Sabaneta.

In the sweltering heat, a Russian choir dressed in black sang the Venezuelan anthem in heavily accented Spanish before Sechin addressed the crowds of mostly red-shirted Socialist Party supporters.

“Thank you for trusting us,” Sechin told the crowd in Spanish during the speech, broadcast on Venezuelan state television. “Russia and Venezuela, together forever!”